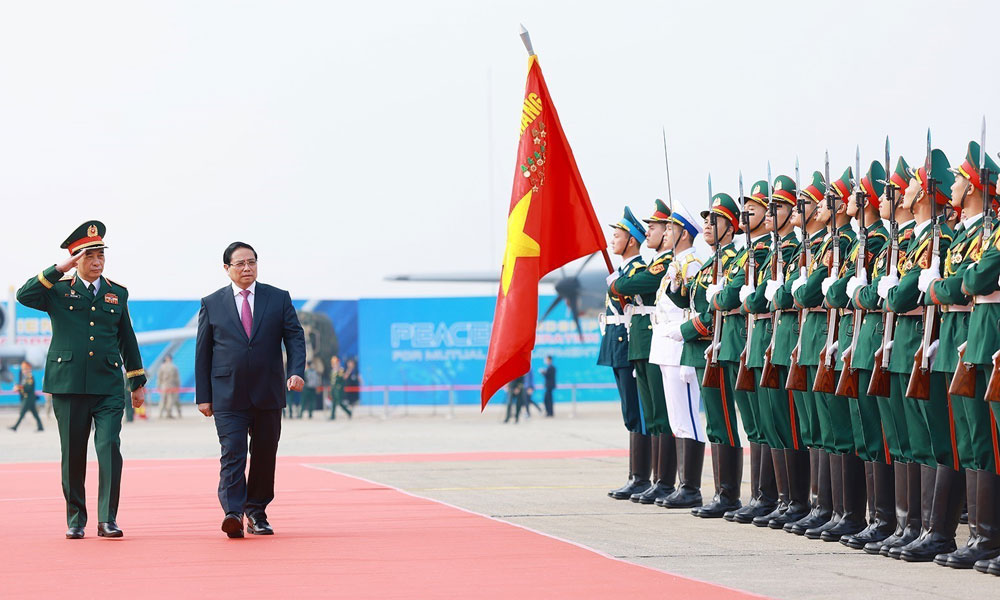

PM urges proactive, flexible, and effective management of monetary policy

Prime Minister Pham Minh Chinh has just signed Official Dispatch No.122/CD-TTg to the Governor of the State Bank of Vietnam regarding the enhancement of credit management solutions for 2024. According to the directive, the State Bank of Vietnam (SBV) is tasked with closely monitoring international and regional developments, including changes in financial and monetary policies of major economies, to analyse and respond with timely and effective policy measures.

The Prime Minister requires the SBV to proactively, flexibly, and effectively manage monetary policy, coordinating closely and harmoniously with reasonably expanded fiscal policy, with focus and priorities, as well as other macroeconomic policies.

|

|

Customers conduct transactions at a Vietcombank branch. |

Specifically, efforts should be concentrated on decisively and effectively implementing tasks and solutions related to managing interest rates, exchange rates, credit growth, open market operations, money supply, and reducing lending interest rates to provide capital to the economy at reasonable costs.

This includes smooth, synchronised, and reasonable management of money inflows and outflows without abrupt actions that could create liquidity pressures on the banking system.

These measures aim to support the public and businesses in overcoming the consequences of storm No.3, recovering, and boosting production and business activities while promoting economic growth in line with macroeconomic stability, controlling inflation, ensuring key balances of the economy, and the safety of banking operations and the credit institution system.

The SBV should also urgently and effectively implement timely credit solutions that align with macroeconomic trends, inflation, and the capital needs of the economy.

These solutions should alleviate difficulties for the public and businesses, support production and business development, and create jobs and livelihoods for citizens in line with the spirit of shared benefits, shared risks, mutual assistance, and support, ensuring that credit is effectively channelled into the real economy.

The SBV must avoid blockages, delays, or misallocation of credit, eliminating corruption or favouritism in the credit granting process. The target for credit growth in 2024 is set at 15%.

Moreover, the SBV should continue implementing effective and stronger measures within its authority to reduce lending rates across the credit institution system, supporting the public and businesses in their production, business, revenue generation, and loan repayment activities.

The Prime Minister directs credit institutions to focus credit on production and business sectors, priority areas, and economic growth drivers such as digital transformation, green transition, climate change response, circular economy, sharing economy, science, technology, and innovation.

At the same time, they must strictly control credit in high-risk sectors to ensure safe and effective credit activities. Credit institutions are also urged to continue implementing policies to address difficulties for businesses and individuals accessing credit.

Credit institutions should also accelerate lending to support production, business, and consumption needs for the end of the year and the Lunar New Year (Tet) of 2025.

At the same time, they should continue making further efforts to reduce lending interest rates by cutting costs, simplifying administrative procedures, and enhancing the application of information technology and digital transformation.

Bắc giang

Bắc giang

Reader's comments (0)