Monetary policy helps support Vietnam’s economic recovery and growth

Vietnam’s economy got off to a good start in the first quarter of 2021 thanks to strong recovery in exports, but the Delta variant forced many provinces and cities to impose social distancing measures, which dealt a major blow to the economy.

|

|

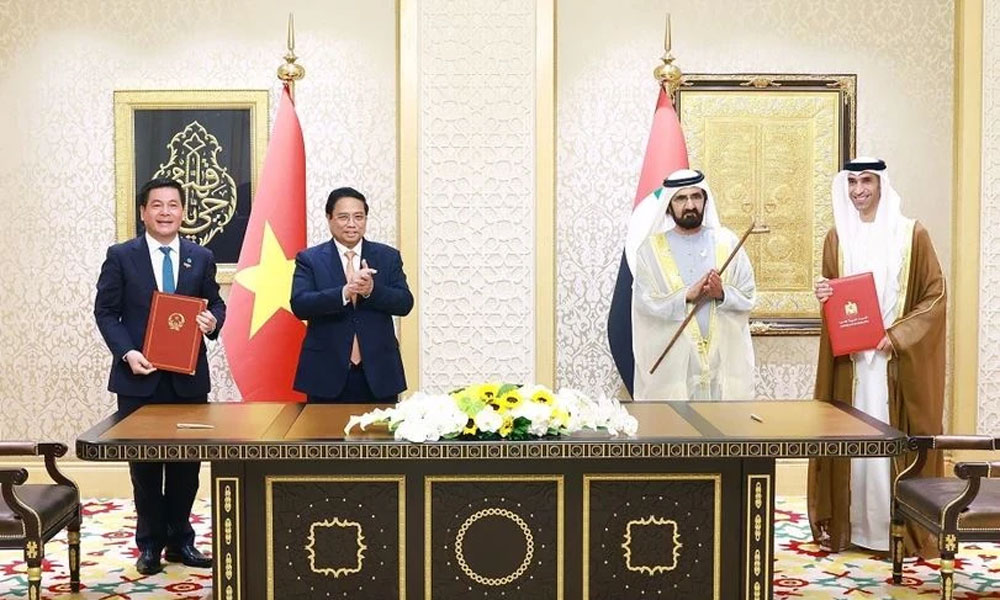

Transactions at a Vietnamese bank. |

The economic picture became brighter in the fourth quarter as businesses started their recovery efforts following the easing of restrictive measures. But whether or not the growth momentum will be sustainable is still uncertain as the Covid-19 pandemic remains complicated with the recent emergence of the more transmissible Omicron variant.

After three rounds of interest rate cuts in 2020, the State Bank of Vietnam has kept its rates unchanged in 2021 to facilitate credit institutions to access funds from the central bank with low costs and directed commercial banks to lower their lending rates in an appropriate manner. As a result, overall loan rates dropped by an additional 0.77 percentage points following the reduction of 1 percentage point in 2020.

The exchange rates between the US dollar and the Vietnamese dong have remained stable, while many major currencies in the region fell sharply compared to the US dollar. Market liquidity was guaranteed and legal demand for foreign currency was met.

Based on the economic growth target of 6.5% and inflation of 4% for 2021, the State Bank set the credit growth target for the whole year at 12%, with flexible adjustments in accordance with the actual situation. Vietnam’s central bank also continued to instruct commercial banks to focus their lending on manufacturing and other priority sectors while restricting lending to risky sectors such as property and securities.

As of the end of November 2021, credit has grown by 10.77% compared to the end of 2020 and it is expected that the target of 12% will be achieved by the end of the year.

The Vietnamese economy in 2021 had to face unprecedented challenges due to Covid-19 resurgence but with the strong determination to adapt safely and flexibly to the pandemic, business activities are gradually returning to normal. The State Bank’s relaxed monetary policy is regarded necessary as Vietnam is only in the initial phase of recovery and enterprises still need significant amounts of capital to revive their operations.

But the IMF projected that in 2022, commodity prices and inflation will remain high due to supply shortages and monetary policy in major economies will be tightened to contain inflation. Such factors along with the pandemic’s unpredictability will make global economic recovery uncertain and full of risks.

In Vietnam, the inflation pressure is also rising, posing challenges to the State Bank of Vietnam’s regulation of monetary policy. Some international organisations have forecast that inflation in Vietnam next year will be around 3.5-4% and may even be higher depending on global commodity prices.

Therefore, to support economic recovery and growth, the State Bank needs to continue a proactive and flexible monetary policy, step up measures to address difficulties facing customers affected by Covid-19, watch the situation closely to introduce prompt response policies, combine the monetary policy with fiscal and other macroeconomic policies to contain inflation, and consider making appropriate adjustments to interest rates.

Source: NDO

Bắc giang

Bắc giang

Reader's comments (0)