Over 99% of enterprises apply for electronic tax payment

Updated: 18:21, 16/08/2022

As of July 15, an estimated 850,444 enterprises, equivalent to 99.3% of the total enterprises in Vietnam, had registered to use the electronic tax payment service with tax agencies, according to the General Department of Taxation.

Those having completed applying for the service with banks are estimated at 849,036, or 99.18%.

|

|

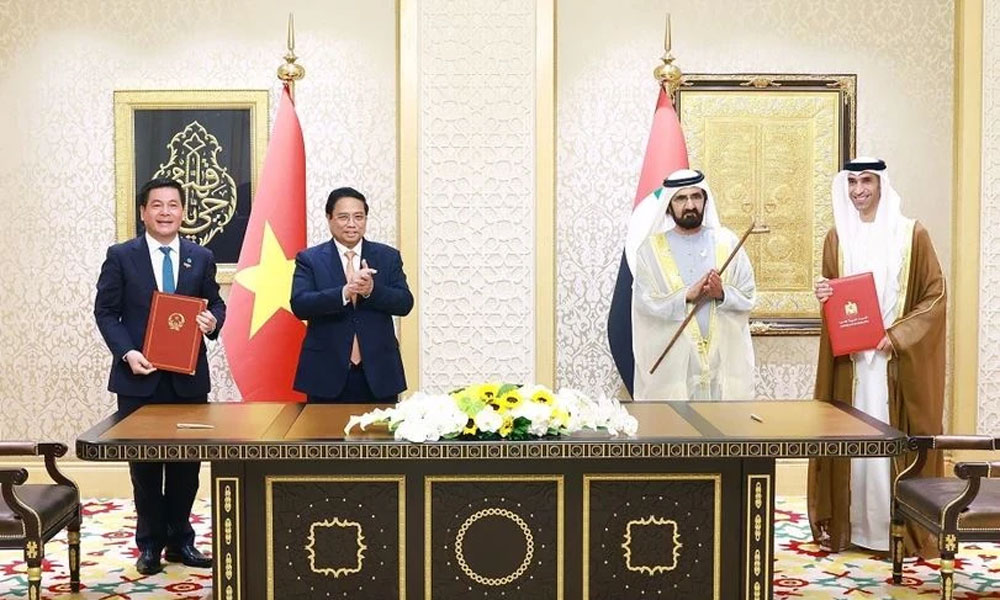

Illustrative image. |

During the period from January 1-July 15, enterprises paid their taxes worth 421 trillion VND (39.2 million USD) utilising nearly 2.2 million electronic transactions.

As of July 15, eTax Mobile - the tax application for smartphones - recorded over 84,700 installations. There have been a total of 52,800 bank transactions worth 264 billion VND conducted on the app.

Finance ministry proposes tax cuts on gasoline

The Ministry of Finance has apprised the government of its plan to reduce special consumption tax and value-added tax on gasoline to bring its prices down.

Banks introduce eTax Mobile service

The first six banks have provided accounts for users to make online tax payments via the eTax Mobile application.

Enterprises recover, well implement tax policy

(BGO)- Covid-19 pandemic outbreak in Bac Giang

province in the middle last year adversely impacted operation of almost

companies. However, thanks to the great efforts to overcome difficulties,

several enterprises have recovered their production and business with

dramatically increased turnovers and made positive contribution to the state

budget.

6 out of 16 tax revenues in Bac Giang surpass from 5 to 37 percent against the same period

(BGO)- According to the Taxation Department of

Bac Giang province, the total domestic tax revenue in Bac Giang province in the

first 5 months this year is estimated at 6.619 trillion VND (285 million USD),

up 6 percent against the same period last year and equal to 53 percent of the yearly

tax estimate.

Vietnam approves tax system reform strategy until 2030

Deputy Prime Minister Le Minh Khai has signed a decision on approving the tax system reform strategy until 2030 with the goal of streamlining tax management and expanding the tax base.

Source: NDO

Bắc giang

Bắc giang

Reader's comments (0)